Betfair Lay Low Structure For UK, IE, AU and NZ Greyhounds

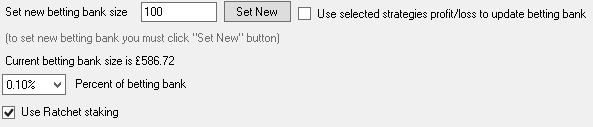

Lay Low uses 0.1% of a £100 virtual bank with a ratchet.

I am writing this article due to the interest the Lay Low Greyhounds Strategy has created in the JuiceStorm Trading room on Skype.

The Betfair Lay Low Structure For UK, IE, AU and NZ Greyhounds is a structure – or strategy – which lays all odds on greyhounds with recovery in the UK, IE, AU and NZ Greyhound markets on Betfair.

This article will be updated from time to time at the bottom.

If you want to try this strategy then get yourself a copy of BfBotManager and then head over to the JuiceStorm Trading room on Skype and ask me for the latest private strategy which you can then import in to BfBotManager.

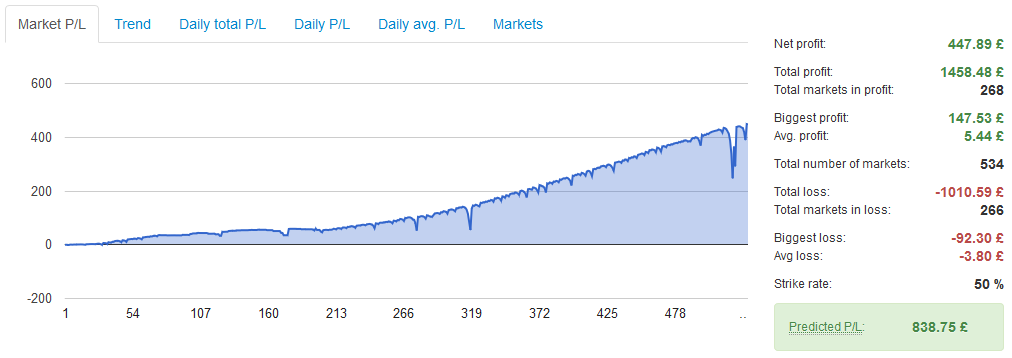

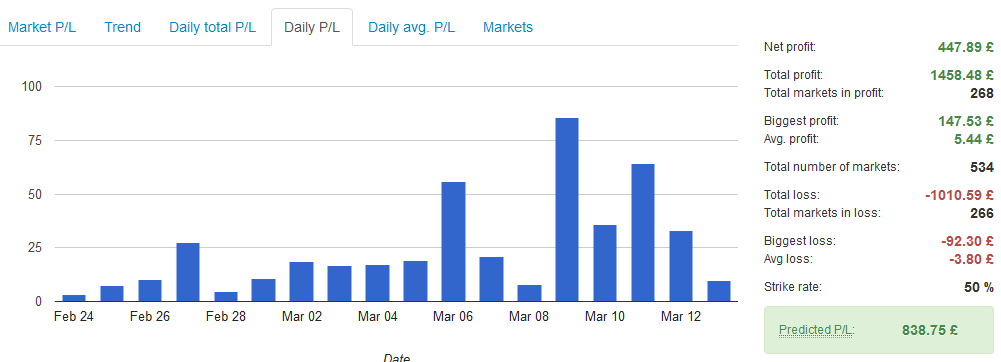

At the time of writing a £100 bank has produced a net profit of £447.89 after Betfair commission in a period of 17 days. Obviously with this level of growth it is NOT for the fainthearted.

At the time of writing a £100 bank has produced a net profit of £447.89 after Betfair commission in a period of 17 days. Obviously with this level of growth it is NOT for the fainthearted.

I did anticipate that it would need to be manually restarted from time to time due to profit or loss. Lay Low has just been restarted to the original settings of 0.1% of a £100 virtual bank with a ratchet. This is one of the few settings that can be changed by anyone that would like to get involved. The settings are all stake related.

I did anticipate that it would need to be manually restarted from time to time due to profit or loss. Lay Low has just been restarted to the original settings of 0.1% of a £100 virtual bank with a ratchet. This is one of the few settings that can be changed by anyone that would like to get involved. The settings are all stake related.

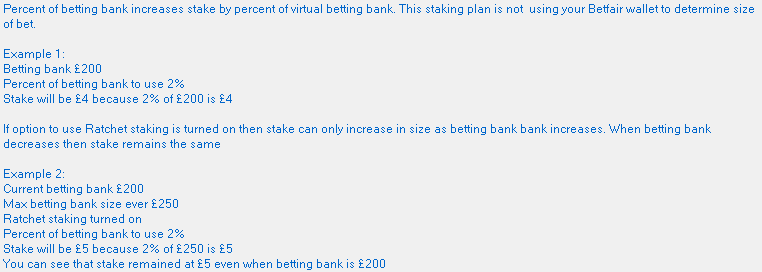

It does not include an automatic reset at a set level which could be integrated because I have always preferred to manage risk by stake size rather than an arbitrary take profit or stop loss when gambling. The opposite is true for trading. The image below gives further detail on how the ratchet works.

It does not include an automatic reset at a set level which could be integrated because I have always preferred to manage risk by stake size rather than an arbitrary take profit or stop loss when gambling. The opposite is true for trading. The image below gives further detail on how the ratchet works.

Lay Low discussion in the JuiceStorm Trading room on Skype is always welcome. Many other topics are covered daily among the nearly 200 members too.

Lay Low discussion in the JuiceStorm Trading room on Skype is always welcome. Many other topics are covered daily among the nearly 200 members too.

Of course, recovery strategies are an anathema to many. The generally held view is that the structure may get away with it for some time, but eventually, you’ll be screwed.

Of course, recovery strategies are an anathema to many. The generally held view is that the structure may get away with it for some time, but eventually, you’ll be screwed.

Many would state it’s a mathematical fact that’s been proved often.

Today I have also created and started two new strategies. They both avoid the open grade favourites which win far more than the 16% of A3 to A12 as Tony mentioned above. The one difference between them is that one operates with the standard recovery and the other doesn’t. Level stakes only but both still use 0.1% of another virtual bank and a ratchet. Other settings are unchanged. I don’t expect many bets but it will be interesting to see how it plays out.

Today I have also created and started two new strategies. They both avoid the open grade favourites which win far more than the 16% of A3 to A12 as Tony mentioned above. The one difference between them is that one operates with the standard recovery and the other doesn’t. Level stakes only but both still use 0.1% of another virtual bank and a ratchet. Other settings are unchanged. I don’t expect many bets but it will be interesting to see how it plays out.

Will Lay Low collapse under the weight of trying to avoid a loss? Yes. But ALL strategies or structures eventually fail anyway. I’m cool with that. Back in the day – nearly 10 years ago – there was a hugely popular strategy that eventually blew up on the seventh reset cycle. Did it matter? Yes. It was irritating. But you dust yourself down, reset and restart. Even allowing for the loss that strategy was hugely profitable due to banked profits that had been withdrawn from Betfair over several months.

Another strategy – a trading structure – that has proved the test of time is the The Charity Betfair Challenge Supporting The Injured Jockey’s Fund. It’s now several years old and has been tweaked many times. Is it still possible to go from £100 to £3,778.02 by Wed, Sep 19, 2018? Well, the account balance now stands at £561.37 on day 174 yesterday and it’s on target. I hope so.

Finally, always remember that except for a Martingale nothing has lost more people more money than tight stops. Tight stops are essentially a guarantee that you will lose all your capital in tiny little chunks or certainly die trying. Tight stops are the trading equivalent of death by a thousand cuts.

is the strategy still working? I would like a copy, to test it

It had a good run but was retired in mid 2019.