A Closer Look at Digitex Futures Exchange Features

Digitex has partnered with Spotware

Let’s take a look at some of the extra features this partnership allows us to bring you in the exchange.

Multi-Browser Compatible

Thanks to Spotware software engineers’ expertise, the Digitex Futures exchange will be accessible from most modern browsers and operating systems, including MacOS. We’re also taking advantage of many of popular trading platform cTrader’s functions and features for Digitex.

It’s also great for Mac users. The Spotware team recognized early on that not enough emphasis was being placed on supporting the Safari browser. With the Digitex Futures exchange, both Windows and Mac users will get an equally seamless experience with the same trading options available.

In addition to the Digitex one-click ladder interface, which will give you lightning-fast functionality for manual trading, you’ll also get the same top-of-the-line charting features. We’ll also be helping all traders to learn to make the best use of the platform through educational materials, so don’t worry if anything is new to you.

Advanced Trading Tools

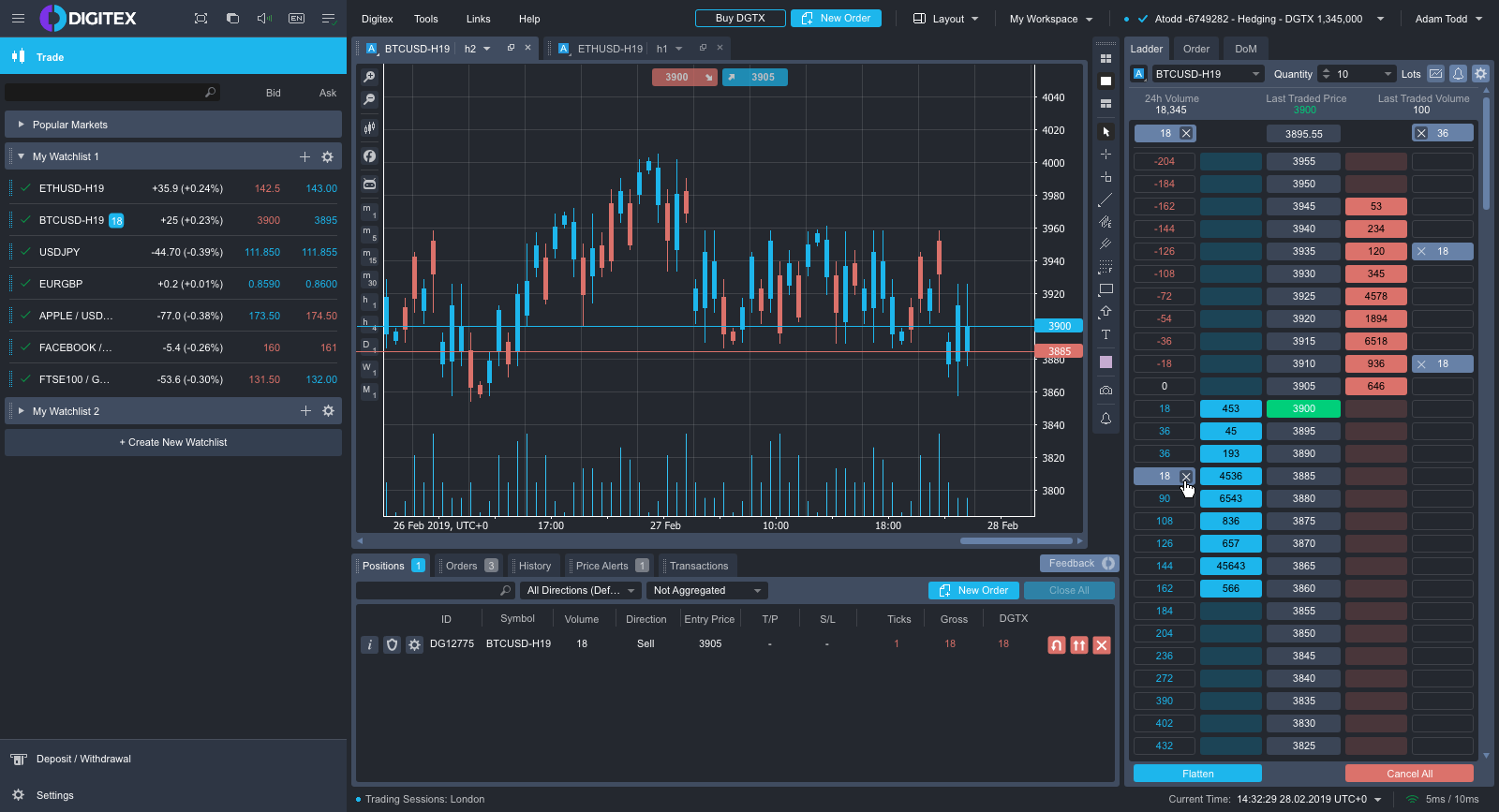

You will have access to multiple order types on your left, the traditional candlestick style chart in the center, and the Digitex ladder on the right so you can see the price action moving up and down constantly.

When you’re trading all day long, having advanced trading tools at your fingertips can greatly ease the process. The Digitex Futures exchange will come complete with the ability to create rules, speed up entry and execution, and make smarter trading choices.

As well as fast submission from the ladder interface, the Digitex platform offers you multiple order types using traditional order placements, including Market Order, Limit Order, Stop Order, and Stop Limit Order. These are essentially automated functions like trading bots that allow you to set up requests to buy or sell under specific instructions.

This means you can establish rules within the interface to reduce your manual work and ensure that the system is trading for you when you’re not at your computer.

So, for example, you can create a rule that says never buy higher than the last sale price. But since this only prevents a buy transaction from happening, you can also put a stop-loss rule in place so if the market bottoms out, you won’t be stuck with losing positions and can sell before the dip.

Existing Orders and Positions can always be modified whenever you require. You simply need to drag and drop the corresponding elements on the chart. This is a super-fast way of changing your position to reflect the market and allows you to bypass order tickets for trading at its simplest.

The Digitex Ladder

The Digitex Ladder displays prices vertically, allowing you to see the bids and offers moving up and down the ladder.

One click submission allows you to instantly react to market movements without needing to take your eyes from the price or use the keyboard.

The BTC tick value is currently set at $5, reducing noise and unwanted movement in pricing allowing for a tight bid/offer spread.

—Price moves up and down

—Visualise up and down price movements much easier

—Submit trades instantly (one click) at any price, make or take

—See & Take profit/loss in one click (One-click flatten)

—See gaps in the prices instantly

—Quick cancel

—Live volume & Traded amounts

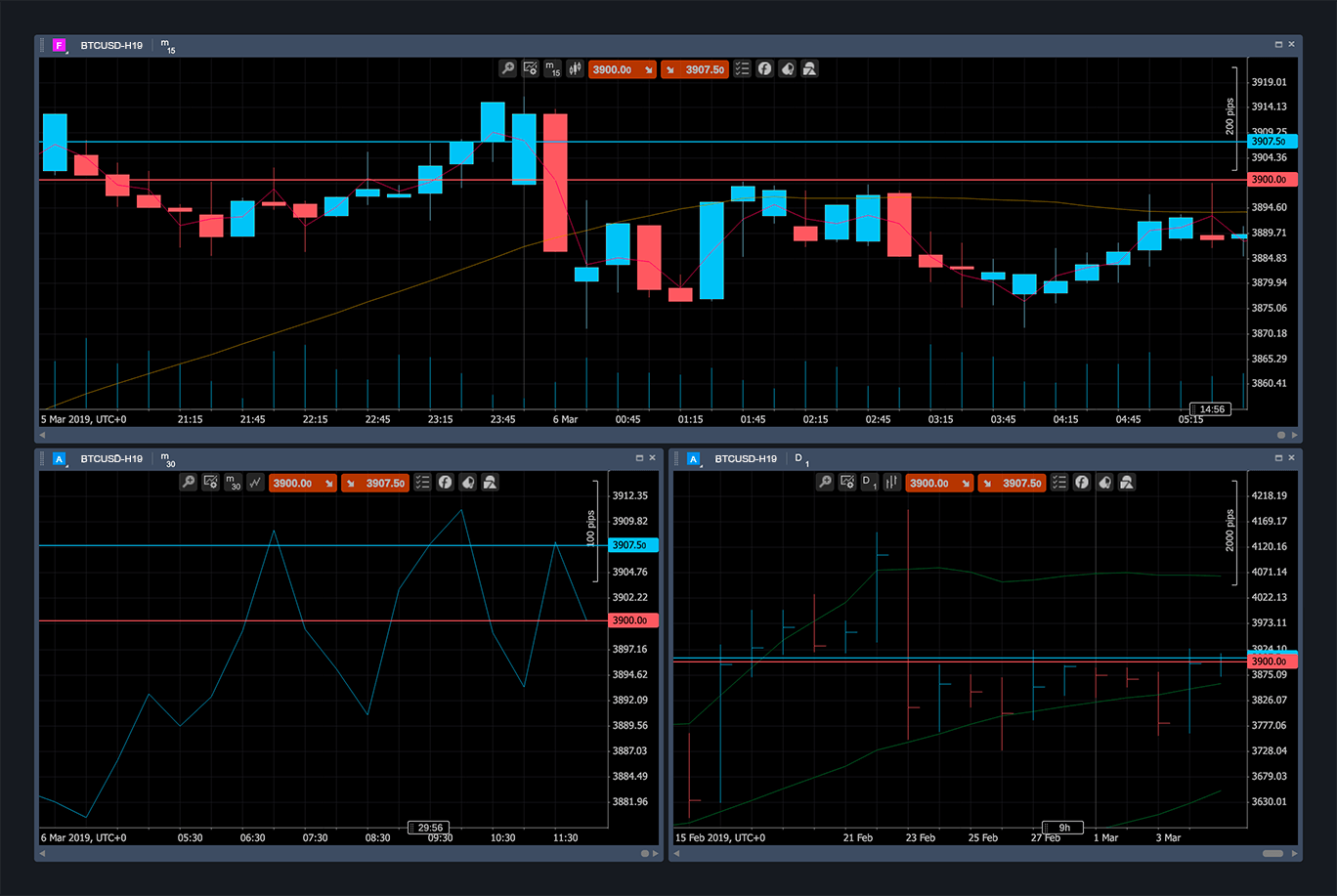

Charting & Chart Trading

Thanks to Spotware’s advanced features, you’ll be able to view the charts in a way that’s comfortable to you, through the traditional candlestick model below, or through bar charts, or tick charts, for example. This is customizable for every trader so you can view the screen in the way that suits you best.

You can also take screenshots of the charts and share them easily with other traders through multiple sharing options. This makes it even simpler to get advice or discuss the latest price action with other traders before making a move.

You can also create orders directly from the chart by right-clicking on the desired price level and selecting Create New Order to proceed to the New Order menu. Alternatively, you can select Sell/Buy Limit, Buy/Sell Stop or Buy/Sell Limit to create the respective order directly on the desired price level. You can also set up price alerts, active positions, and pending orders.

The Takeaway

These are just some of the awesome features you can look forward to from the public launch. Remember, we may be making use of Spotware’s expertise in trading platforms, but this is the first futures exchange and first zero-fee exchange they’ve ever built. This makes the partnership all the more fulfilling for both side and will lead to a truly extraordinary exchange like nothing else out there on the market.