Cryptocurrency Market Trends to Watch

We are well into the final three months of 2019.

It’s hard to believe that we are well into the final three months of 2019. In regard to the cryptocurrency universe, 2019 will probably be remembered as a year of consolidation. The first six months of the year were a roaring bull market. However, during the past few months, cryptocurrencies have rolled over to the downside. As we prepare for the testnet launch next month, let’s take a look at what’s happening in the industry. What type of price activity can we expect, bullish or bearish? Check out Autumn’s cryptocurrency market trends below.

Autumn’s Cryptocurrency Market Trends

What are some of the market trends that will drive the cryptocurrency universe during the final three months of the year? It certainly appears that Q4 is setting up to provide plenty of opportunities for those of us involved in cryptocurrencies. Let’s examine a few indicators for Autumn’s cryptocurrency market trends.

The Market Climate Entering the Final Quarter of 2019

Beginning in March, BTC enjoyed a dramatic rally of 256% over the course of three months (Chart #1).

The rally peaked on 26 June @ 13,844, which marked the high for 2019. During the past few months, the bears have slowly recaptured the momentum. As we embark on the final three months of 2019, the trend is definitely bearish. But will the bulls be able to reverse the trend by the end of the year?

One of the most popular indicators within the crypto trading community is the 50-day simple moving average (50 SMA). This indicator is the easiest and most reliable way to calculate the underlying trend of the market.

As of 9 October, the 50 SMA for Bitcoin is 9,964 (Chart #2).

Currently, BTC is trading below the 50 SMA. Therefore, this indicator is bearish. In order for the indicator to turn bullish, the price of BTC must exceed the 50 SMA.

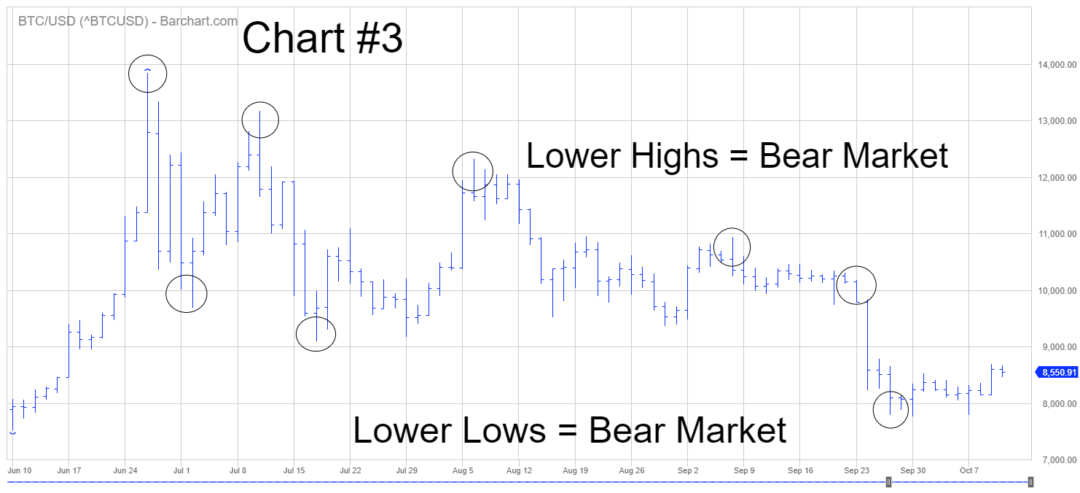

Another way to calculate Bitcoin’s trend is by determining the current price pattern. If the trend is bullish, BTC will generate a series of higher highs and higher lows. If the trend is bearish, BTC will produce lower highs and lower lows. Please review Chart #3.

As you can see from the chart, Bitcoin’s current price pattern is bearish. Why? Because BTC has been recording a series of lower highs and lower lows. Until this string is broken, Bitcoin will remain bearish. The price pattern will turn bullish when BTC exceeds 10,180.

Commission-Free Trading Is Pushing Forward

Another key one of Autumn’s cryptocurrency market trends is that commission-free trading is becoming a reality across the online world. Brokerage firms have been using a commission-based model dating all the way back to the formation of the New York Stock Exchange in 1817.

The commission-based model has encountered very few changes during the past 202 years. The only significant change occurred in 1975 when the Securities and Exchange Commission (SEC) allowed brokerage firms to set their own price in terms of the commission rates.

Then, in 2013, two young entrepreneurs by the names of Baiju Bhatt and Vladimir Tenev formed a brokerage firm by the name of Robinhood Markets Inc. Robinhood became the first-ever commission-free brokerage firm. Customers could purchase stocks and ETFs commission-free. The brokerage firm immediately became a huge success. Today, Robinhood is stronger than ever with over 4 million active users. The brokerage firm is currently valued at over $7 billion.

Robinhood validates the fact that commission-free brokerage firms have the potential to become incredibly successful. Robinhood has enjoyed so much prosperity during the past few years that the “big three” online brokerage firms recently joined Robinhood in offering commission-free trading to its customers. The “big three” firms include Charles Schwab, E*TRADE and TD Ameritrade. Additionally, in August 2019, mutual fund giant Vanguard began offering commission-free trading on over 1,800 ETFs.

Commission-Free Trading in Cryptocurrencies

There’s no turning back. The brokerage industry’s commission-based model has officially been replaced by commission-free trading. How will this change affect the trading of cryptocurrencies? Currently, all crypto exchanges are using some type of commission-based model. This includes crypto futures, crypto derivatives and crypto cash trading.

Traders are charged some type of commission rate or transaction fee for buying and selling each of these three crypto trading vehicles. However, the current commission-based crypto model will soon be replaced by a commission-free model.

Digitex Futures is working on a zero-fee cryptocurrency futures exchange that will revolutionize the way people trade cryptos. With the public testnet coming up next month, zero-fee will be an important one of Autumn’s cryptocurrency market trends.

It’s only a matter of time before all major asset classes will be available for trading on a commission-free basis.

Governments to Issue Their Own Cryptocurrencies?

When Satoshi Nakamoto mined the first block of bitcoins on 3 January 2009, this marked the beginning of a potentially new global currency system. Of course, very few people or institutions were paying attention to BTC in 2009, including federal governments. In fact, governments completely dismissed cryptocurrencies for the first six to eight years of their existence. Many government monetary officials originally classified Bitcoin (and other cryptocurrencies) as a Ponzi scheme.

Throughout all of 2017, federal governments from around the world slowly began to change their viewpoint in regard to cryptocurrencies. They began to realise the benefits of using a cryptographically secure currency system.

Today, several of the G20 economic leaders are in the process of determining how to incorporate cryptocurrencies into their current fiat money system. The current plan among most G20 nations is to combine cryptocurrencies with the current fiat system. Of course, the Bitcoin community is convinced that governments will choose BTC as their cryptocurrency. Most likely, it will take at least a few more years before governments decide how to proceed in this area.

Many people erroneously believe that federal governments rarely change their nation’s monetary system. This is simply not true. For example, the United States Treasury Department, along with the Federal Reserve, has completely overhauled its monetary system on three separate occasions during the past 100+ years. Other nations have also made significant adjustments to their monetary system.

The last change occurred in 1971. Therefore, the U.S. monetary system is overdue for some type of major adjustment. It’s not likely that this will be this year, however, Autumn’s cryptocurrency market trends are showing many countries are seriously considering this from the Marshall Islands to China and even Germany.

Most likely, the next monetary change will be global in nature, similar to the Bretton Woods Conference. Adopting some type of global cryptocurrency monetary system is the most likely change that will take place, probably within the next few years.

Final Thoughts

The final three months of 2019 are setting up to be an exciting time period in the cryptocurrency universe. In terms of crypto prices, Bitcoin could be on the verge of coiling up for a big move, particularly if BTC can penetrate 10,180.

In regard to the macro picture, we continue to see a steady increase in crypto global adoption. Three years ago, central banks around the globe thought cryptocurrencies were a joke. Today, these same central banks are on the verge of adopting cryptos as an official component of their monetary system. Cryptocurrencies are here to stay. Trading them will soon be commission-free and more and more people will understand their worth.