Bitcoin Looks Almost Exactly Like It Did Prior to the 2016-2017 Explosion

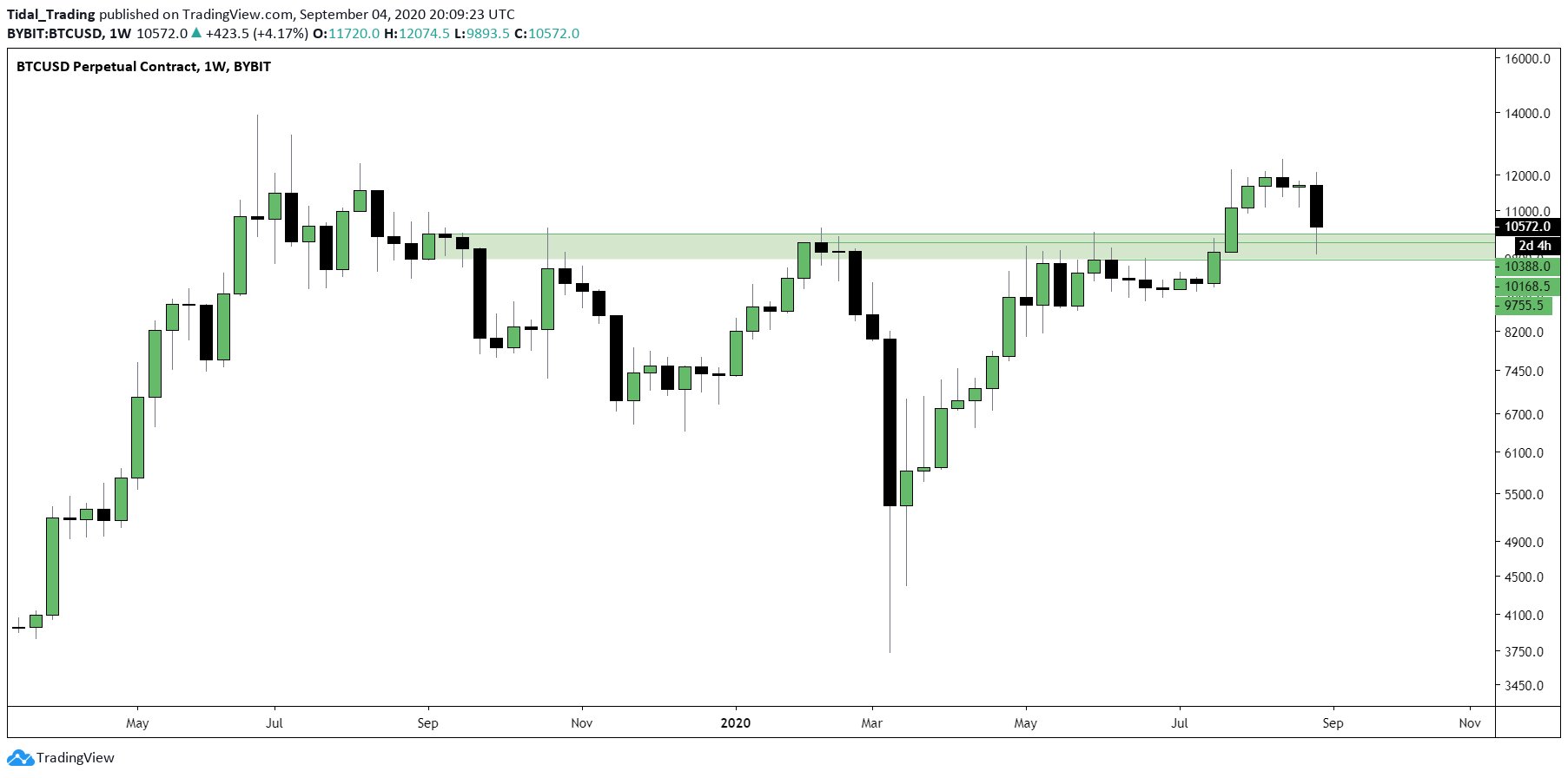

- Bitcoin has seen a strong reversal over the past few days after it was once again rejected at $12,000.

- The leading cryptocurrency now trades for $10,500, trading around pivotal technical levels.

- BTC has yet to post a notable close above or below these pivotal levels, but traders are keeping a close eye on the charts.

- One analyst argues that Bitcoin’s recent weakness is actually just par for the course.

- He notes that from a macro perspective, BTC actually looks similar to where it was when it began the 2016-2017 exponential rally.

- This is in line with a series of analysts who say that Bitcoin remains in a good spot on a macro time frame despite recent weakness.

Bitcoin Could Soon Surge if History Repeats Itself

Bitcoin is primed to begin a macro rally from here if history repeats itself, a recent analysis by a crypto chartist indicates.

The chartist shared the chart below on September 3rd. It shows that BTC’s about to bounce off a pivotal downtrend from the $20,000 all-time high.

While not identical per se, BTC completed a similar retest at the start of the previous bull run, where it retested the resistance of the $1,300 all-time high as support before rallying higher.

Should history repeat, BTC will not begin its bull run after it prints a clean bounce off current price levels:

“BTC weekly: 2015 -vs- 2020. Retest of descending trend line. After the successful 2015 retest, BTC ran 8,000% into the Dec 2017 ATH. Silly hopium?”

Not Entirely Unlikely: BTC’s Macro Chart Structure Remains Bullish

Corroborating this sentiment that BTC is on the verge of a macro upswing is other analyses of the cryptocurrency’s macro price action.

One trader recently shared this chart below. It shows that Bitcoin’s recent price action is actually a clear retest of a macro support level, not a bearish breakdown as many have noted:

“$BTC funding and premium index reached the lowest it had been since March 19th yesterday… Except this time we’re retesting a multi-year S/R level with a confirmed bullish break in MS all the way up to the monthly chart…”

The fundamentals of the industry remain positive. For one, Fidelity Investments was recently revealed to have begun work on a Bitcoin fund focused on offering BTC exposure to institutional clients.