Bitcoin Large Holders Open Massive Short Position Amid Brief Upward Move

Excitement has swelled in the crypto community following Bitcoin‘s recent upward move to key resistance levels. While the move may have sparked optimism, many investors’ reactions toward BTC were negative as they continued to bet on a sustained decline, creating a bearish outlook for the asset.

Whale Shorting Activity On The Rise

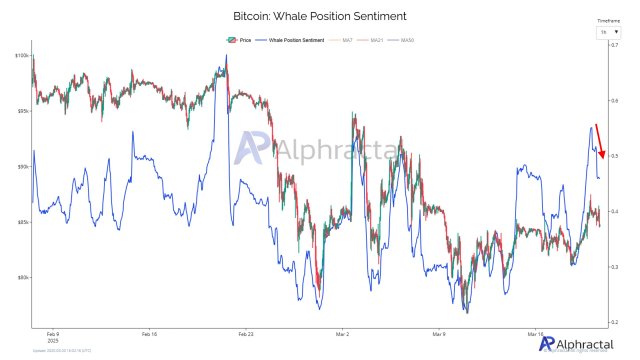

As Bitcoin’s price struggles to break through key resistance levels, a worrying shift has been cited among big investors or whales. Alphractal, an advanced investment and on-chain data platform reveals rising pessimism among these investors as they bet on an extension of the ongoing correction.

BTC recently saw a brief surge to the $87,000 level even as volatility grows in the broader crypto market. However, the upward move was met with strong resistance as whale holders massively opened short positions after the upswing. “Whales Enter Short Positions on Bitcoin as Leverage Increases,” the platform stated.

Despite the brief move to the $87,000 mark, these big investors have chosen to close their long positions and open more shorts. Given the ongoing volatility of the market, this shift has raised questions about BTC’s prospects in the short term.

Whale participation often influences price trajectory, which could cause Bitcoin to continue dropping in the upcoming weeks. However, if buying pressure intensifies at critical support zones and creates a strong defense, BTC may move in an upward direction.

Furthermore, Alphractal points to a rise in market leverage. After examining the Bitcoin Aggregated Open Interest/Market Cap Ratio, the platform noted that the metric is rising again, reflecting growing leverage. According to the platform, this increase in market leverage might set off a fresh round of volatility, resulting in further mass liquidations.

On-chain data have also revealed substantial sell pressure among Bitcoin large investors, triggering concerns about potential downside risks. Leading market intelligence and data analytics platform IntoTheBlock, outlined a decrease in whale balances as the market fluctuates.

Looking at the chart, BTC whales seem to have been trending downward for almost a year. However, data from March suggests a potential reversal as whales now hold about 62,000 more BTC than they did at the beginning of the month, signaling renewed accumulation.

BTC’s Price Trading Within Key Chart Pattern

The renewed accumulation by BTC whales raises the likelihood of a price reversal from the ongoing downtrend. This price reversal could be part of a larger trend as Captain Faibik, a crypto analyst and investor predicts an impending surge to its current all-time high. His prediction is supported by a key chart pattern, particularly the Falling Wedge formation.

Captain Faibik believes that BTC could consolidate within the key pattern for the next 10 to 15 days before undergoing a huge bullish breakout. When this breakout happens, Bitcoin’s price will rally significantly to the $109,000 mark, reigniting the bull market.

Featured image from Unsplash, chart from Tradingview.com

Editorial Process for WhyLose is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.