Why Investors Are Shifting from Gold to Bitcoin

Investors are turning away from traditional safe-haven assets like gold

- Digitex Has Been Two Years in the Making - November 27, 2019

- Digitex Futures Is Ready to Revolutionize Futures Trading - November 26, 2019

- With 4 Days to Go, Check Out the Progress on the Digitex Testnet - November 26, 2019

What’s Happening to Traditional Assets Like Gold?

The financial universe is divided into five major asset classes. These include stocks, bonds, commodities, alternative investments, and cash.

Without question, the most popular investment vehicle within the category of alternative investments is the gold market. The “yellow metal” has been used as a store of value, medium of exchange, and universally accepted method of payment for over 3,000 years.

Throughout history, it has been used by kings and queens, federal governments, international banking institutions, and wealthy families as the most recognized form of wealth. However, during the past several years, gold has been slowly been losing its luster as the investment vehicle of choice within the financial industry.

So, what happened to gold? Why did it lose its prominence among traders and investors? More importantly, is it any coincidence that gold began to fade in popularity at the precise time that Satoshi Nakamoto introduced Bitcoin (BTC) to the world? The short answer is, “No.”

It’s definitely no matter of chance that BTC has been outshining gold, particularly during the past 24 to 36 months.

We are in the process of witnessing an underlying shift within the investment community. Investors are turning away from “hard” assets (or physical assets) like gold, silver, artwork, rare coins, and antiques, toward digital assets (like Bitcoin and other cryptocurrencies).

Investors Are Moving to Digital Assets

Lately, there has been a growing number of experts in the financial services industry who claim that investments (in general) are slowly moving to a 100 percent digital format.

These industry experts predict that cryptocurrencies will eventually become a leading asset class which will replace physical assets. Based on the fact that gold is the most popular physical asset, it will experience that greatest amount of disruption as investors transition into digital assets like BTC.

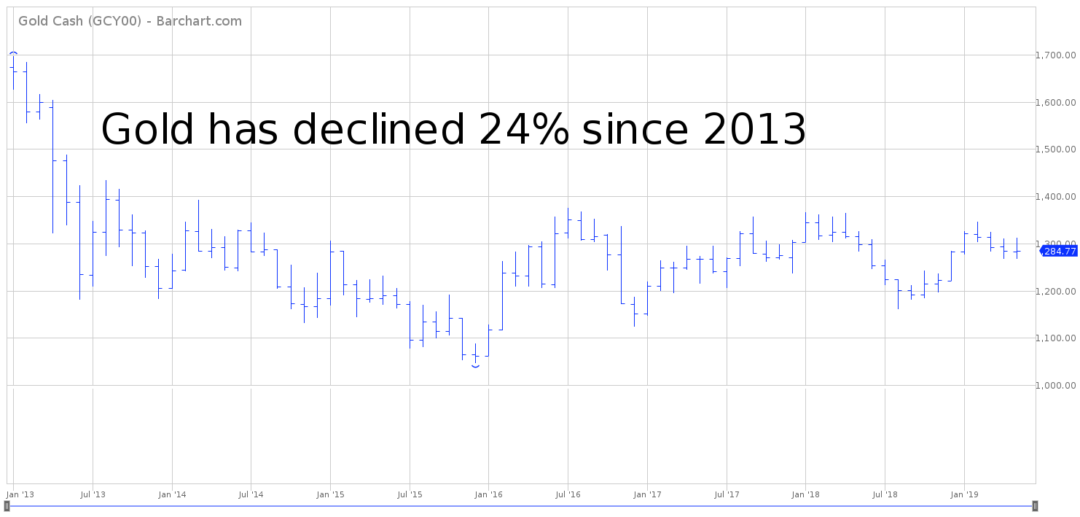

There’s no denying the fact that gold has definitely taken a back seat in the new “digital asset revolution.” If you remain skeptical that this transition is actually occurring, take a look at a price chart of gold dating back to 2013.

The price of gold has decreased 24 percent over the course of the past six years, as investors move away from gold into digital assets like Bitcoin. During the same time period, digital currencies like BTC have literally exploded in price and volume.

These days, it’s not uncommon for traders and investors to buy and sell over 150,000 bitcoins per day. This represents over $1.2 billion in nominal value on a daily basis. In percentage terms, Bitcoin volume has increased by over 39,000% during the past six years! The increase in price and trading volume has been truly spectacular.

Of course, most experts in the gold industry argue that BTC is simply a fad or a “flash in the pan.” They claim that gold will come roaring back during the next financial crisis (as Bitcoin and other cryptocurrencies fall out of favor).

Maybe the gold experts are correct. Maybe digital assets will collapse in value when the global economy experiences another financial crisis. We won’t know the answer until the next crisis unfolds. However, at least for now, it appears that Bitcoin and other cryptocurrencies have become a permanent fixture within the global investment community.

Bitcoin Volume vs Gold Volume

If you’re still not convinced, please examine the following data, courtesy of Satoshi Capital Research.

· 2015 Bitcoin Notional Trading Volume – $12 billion

· 2016 Bitcoin Notional Trading Volume – $31 billion

· 2017 Bitcoin Notional Trading Volume – $870 billion

· 2018 Bitcoin Notional Trading Volume – $2,204 billion

Notional trading volume is the total value of BTC spot trading combined with futures trading. As you can see, volume has literally exploded during the past few years. These numbers are absolutely incredible.

Bitcoin notional trading volume has increased by 18,266 percent since 2015. BTC suffered its worst bear market of all-time in 2018. However, trading volume still increased by 153 percent in comparison to 2017. These numbers clearly verify that demand for cryptocurrencies is stronger than ever.

Now, let’s compare the trading volume of the gold market based on the number of contracts traded at the COMEX division of the Chicago Mercantile Exchange (CME).

· 2015 Gold Futures Volume – 41,847,338 contracts 3.3% increase

· 2016 Gold Futures Volume – 57,564,840 contracts 37.5% increase

· 2017 Gold Futures Volume – 72,802,171 contracts 26.5% increase

· 2018 Gold Futures Volume – 80,301,590 contracts 10.3% increase

Gold futures volume has certainly increased during the past four years. However, the increase has been minimal compared to Bitcoin volume. The average annual increase in gold futures volume is 19.4 percent from 2015 through 2018. These numbers are minuscule compared to the volume increase in BTC.

The Price of Bitcoin Based on Gold’s Notional Value

The Value of Gold

As we move into 100 percent digital format, many investors believe that gold will lose its appeal as a store of value and medium of exchange. Why? Because (in comparison to Bitcoin) gold is an inferior product. For example, in terms of transportation, Bitcoin is much easier to transport. It’s much easier to move a series of letters and numbers versus several bars of gold.

Additionally, you can’t visit your local grocery store and purchase food with a gold coin. However, you can purchase goods and services with BTC. Overall, Bitcoin is simply a better store of value and medium of exchange.

What if Bitcoin actually replaces gold as a major asset class over the course of the next decade?

How high will Bitcoin advance? What is the true value of Bitcoin in a world where gold is no longer the leader among alternative investments? Of course, it’s impossible to accurately forecast the future value of BTC. However, we can certainly make an educated guess. Let’s calculate the numbers.

There are 32,150 ounces in one metric ton of gold. According to the World Gold Council, there are 190,040 metric tons of gold in the world. This figure only includes the above-ground supply. It does not account for gold located in mines, oceans, and other undiscovered deposits. Therefore, the total supply of gold is 6,109,786,000 ounces (approximately 6.1 billion ounces).

Based on the current price of gold at $1,286 per ounce, the total value of all gold is approximately $7.5 trillion.

The Value of Bitcoin

Arguably, Satoshi Nakamoto’s greatest contribution to Bitcoin was the fact that he limited the total number of bitcoins to 21 million. This is what separates BTC from all other fiat currencies. Global central banks can print money out of thin air, which constantly lowers the value of their domestic currency through inflation. Bitcoin does not fall into this category. It can’t be printed out of thin air. That’s the pure beauty of Bitcoin.

Based on the fact that the total value of all gold in the world is $7.5 trillion and BTC is limited to 21 million, what is the potential value of Bitcoin? The answer is $357,000 per Bitcoin. Of course, this number seems almost impossible to comprehend, given the fact that BTC is currently trading around $8,000.

Mark Yusko of Morgan Creek Digital is one of the leading experts in the global Bitcoin community. Yusko has an excellent long-term track record in terms of managed money. He has staked his reputation on the bold prediction that the price of BTC will exceed the value of all outstanding gold within the next decade.

Yusko’s long-term forecast is $400K to $500K per BTC.

Will BTC exceed $400K by 2029? Currently, it seems rather unlikely. However, nobody thought Bitcoin would increase from less than 1 cent to almost $20K in nine years. Therefore, anything is possible. The next decade will certainly be exciting within the Bitcoin community!

Full Disclosure: I own BTC on the spot market, BTC futures, and BTC exchange-traded notes. I have no financial relationship with Mark Yusko or Morgan Creek Digital.