Making Your First Purchase Of Bitcoin With JuiceStorm.com

When institutions invest, they typically buy only Bitcoin.

I have helped dozens of readers here take their first steps into crypto over the last 5 years. Most have done very well and long term, in my opinion, everybody will make significant returns. The number of readers that contact me about making their first Bitcoin purchase has increased significantly over the last few months and, in most cases, I have just sorted it all out for them without any onboarding nonsense or KYC from crypto exchanges.

A CFA Institute Research Foundation report looked at the impact of Bitcoin on a diversified portfolio between January 2014 and September 2022. Over this period, a quarterly rebalanced 2.5% allocation to Bitcoin improved returns from a traditional portfolio by nearly 24%.

That’s a massive impact from a tiny allocation. It’s also hardly surprising: Bitcoin appreciated by approximately 2,875% over the period.

Most experts agree that cryptocurrencies should make up no more than 5% of your portfolio.

This amount is “small enough to keep an investor comfortable in periods of high volatility, but also large enough to have a truly positive impact on the portfolio if crypto prices rise,” says Bruno Ramos de Sousa, head of global expansion at Hashdex.

Some experts, such as Aaron Samsonoff, chief strategy officer and co-founder of InvestDEFY, allow for allocations as high as 20%. But how much crypto should be in your portfolio ultimately depends on your risk tolerance and beliefs about crypto.

In addition to outsized long-term returns, cryptocurrencies tend to have excessive volatility.

In the case of the CFA Institute study, the larger the allocation to Bitcoin, the higher the return and the greater the volatility. Between January 2014 and September 2022, the traditional portfolio without Bitcoin yielded a 6.26% return versus the traditional portfolio with a 2.5% Bitcoin allocation, which produced an annual return of 8.6%, which also saw increased volatility.

“The potential for outsized returns coupled with the significant risks of this emerging asset class means that a very small allocation is sufficient,” says Ric Edelman, founder of Digital Assets Council of Financial Professionals and author of “The Truth About Crypto.”

Experts say that a small amount can materially improve your overall returns without leaving you at risk of financial harm if your cryptocurrency investment declines significantly or even falls to zero.

“Adding some to your portfolio can be a great way to really take advantage of long-term gains while knowing that if you don’t make it big, you aren’t out your whole investment portfolio,” says Callie Stillman, partner at Lift Financial.

What Should My Crypto Portfolio Look Like?

Once you’ve decided how much cryptocurrency to own, the question becomes which crypto assets to buy and how much to hold.

Edelman suggests four crypto portfolio options. First, you could own Bitcoin only. It’s the oldest and largest digital asset in crypto market dominance.

“When institutions invest, they typically buy only Bitcoin. It might not produce the highest gains, but it’ll be the last to go to zero,” he says.

As Bitcoin’s market dominance fades, it’s increasingly important to diversify your position to capture the complete crypto opportunity set, says Martin Leinweber, digital asset product strategist at MarketVector Indexes.

I offer advice on how to setup your first crypto investment for £490. It’s a one off fee and you get me for life but we must have a chat any UK morning first BEFORE you pay the consultation fee.

That first call is free and if you go ahead you’ll receive a free gift worth £100! No KYC and complete anonymity for all JuiceStorm readers without you lifting a finger.

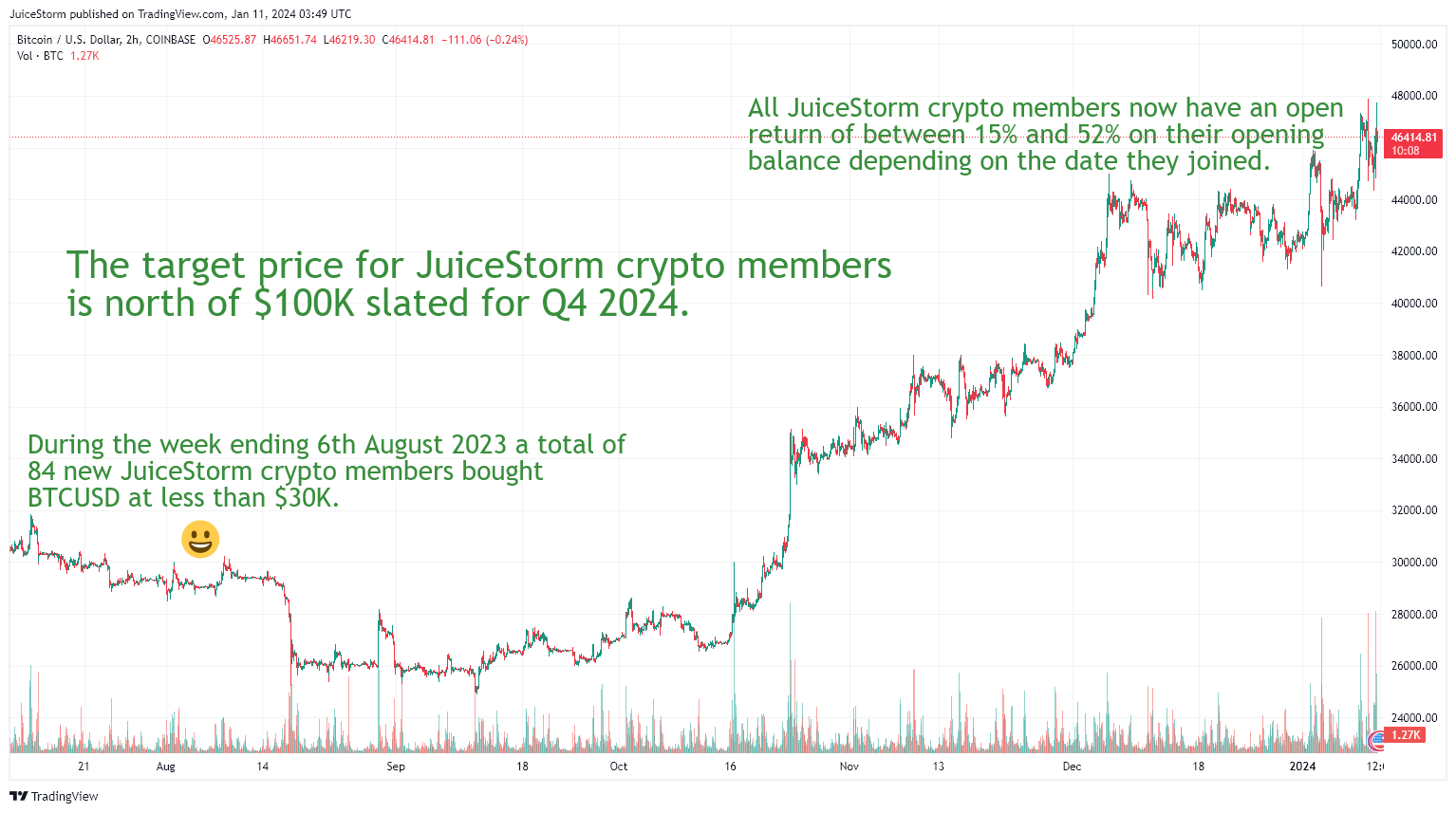

TradingView Chart for BTCUSD on CoinBase

“Different assets deliver notably different return patterns and respond heterogeneously to Bitcoin pullbacks,” says Leinweber. “While short-term correlations can be high, longer-term “Bitcoin has nothing to do with a gaming token such as Axie Infinity or an exchange token such as Binance Coin (BNB).”

A popular alternative to Bitcoin is Ethereum, the second largest cryptocurrency by market cap, with 18% market dominance. “Many believe it has far greater utility for global commerce and therefore will continue to gain in prominence,” Edelman says. Many other coins and tokens also rely on the Ethereum blockchain.

You could also have a portfolio that includes a mix of Bitcoin and Ethereum. “They are the Coke and Pepsi of crypto,” Edelman says. Between them, you have more than 60% of crypto’s market share.

Edelman suggests a 50-50 split or 60-40 favoring your preferred coin. “Otherwise, you’re making a big bet,” and “bets should be avoided as this asset class is plenty risky already.”

While larger coins like Bitcoin and Ethereum may make up a larger share of your portfolio, keeping smaller proportions of other crypto assets can improve your long-term returns, Leinweber says.

How to Manage Your Crypto Portfolio

Keeping a long-term perspective, meaning years and decades, is the key to managing your crypto portfolio. “This is a new and thus very volatile asset class, and you should focus on the potential for profits over decades, not weeks or months,” Edelman says.

Leinweber says that portfolios over a four-year or longer period are generally in profit. “It’s an investment in a new technology and not a get-rich-quick scheme.”

Many experts recommend using a pound-cost averaging strategy where you buy or sell a fixed pound amount regardless of what happens. This can take emotion out of the equation.

“Trying to time the market perfectly or checking your portfolio every day in general leads to more stress and bad decision-making. Instead, it is better to have periodic reevaluations of your positions and rebalancings based on your evolving view of the market, not much different from a stock portfolio,” de Sousa says.

Otherwise, your cryptocurrency allocation could overwhelm your portfolio and increase your overall risk.

“If you’re not an active trader, you should have a steady percentage allocation to crypto and rebalance to your target weights monthly or quarterly,” says Greg King, founder, and CEO of Osprey Funds.

About

PFS member since 1986

The Personal Finance Society is part of the Chartered Insurance Institute – the leading professional body for financial planners.

The Personal Finance Society has 40,000 members worldwide and John has been a member since 1986. WhyLose.com – Lion Asset Management – was founded in 2002 by John to provide financial services for sophisticated investors and Lion News, a subscription newsletter, is mailed to 250K members quarterly.

Good to speak again after so many years. I’m so glad you got me involved in crypto. Doubled my money.

Happy new year lads. Bought 1 BTC August 2023 at $29K. You helped set up my wallet. Now $43K. Thanks.

$21,000 up on Bitcoin and $8,500 up on Ethereum since August 2023 with your help. Best investment ever, appreciated.

On your advice bought 4 #BTC at $31K. Now above $67K. A profit of $144K in 7 months. Thanks JP.

Bitcoin passed $100K in Q4 2024 like you wrote here in August 2023. Profit of $129K. You’re awesome JP.