5 Killer Cryptocurrency Trading Tools

Check out some great cryptocurrency trading tools

- Digitex Has Been Two Years in the Making - November 27, 2019

- Digitex Futures Is Ready to Revolutionize Futures Trading - November 26, 2019

- With 4 Days to Go, Check Out the Progress on the Digitex Testnet - November 26, 2019

Any trader knows that one of the keys to being on their game is getting good at risk management. And when it comes to crypto, that’s almost like breaking in a wild mustang! After all, how do you tame a bucking bronco? If you go in blind, the raging animal will almost certainly stomp right over you. But what if you tried again armed with the knowledge of a well-trained expert?

Wild animals, just like crypto, are unpredictable. But you can start to identify patterns. Using the right tools will show you how to read the markets, how to make use of the price fluctuations between exchanges, and take an educated decision about when to buy or sell. You can even make profits not just when the price swings up, but when it tumbles back down again. You just need a little help.

Cryptocurrency Trading Tools Everyone Can Use

There are a plethora of cryptocurrency trading tools out there and it really depends on your personal tastes and needs as to which you prefer. Many traders use several different tools depending on what they want to know and which metric they’re trying to gauge. However, the following five are ones that every trader should have in their arsenal.

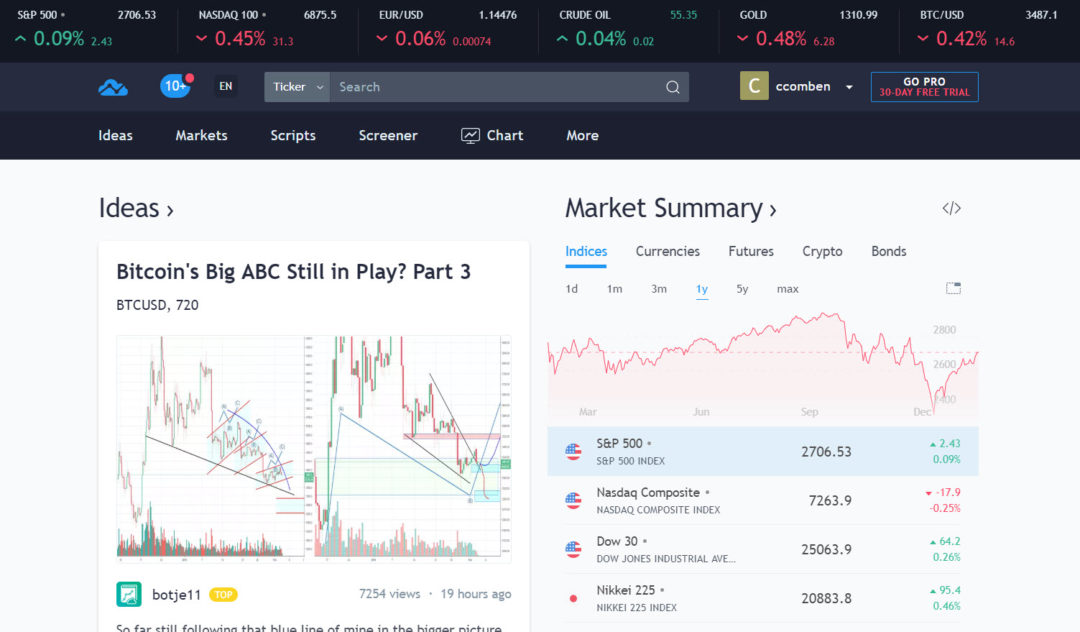

1. TradingView

You can’t trade crypto without being part of TradingView. This is one awesome platform that provides immense value to both traders and investors. Beyond insightful commentary, a killer forum, and useful tips and tricks from successful traders, there’s also a host of excellent tools on hand.

Learn from others the types of strategies they use, as well as how well they work for them. Share comments and feel like part of a trading community, so you’re not just alone at your keyboard all day!

You’ll see in-depth trading analysis in the shape of charts and historical comparisons (as well as which traders get it right more often) and gain valuable overall market analysis. There’s also a bunch of info on stocks and forex, but the bulk of TradingView commentary is on crypto.

This is a site for seasoned traders as well as newcomers, however, it’s especially useful for those who want to know how to compile a technical analysis and build up their trading knowledge.

2. CoinGecko

If you’re really new to trading and looking for a tool that doesn’t come with all the bells and whistles of TradingView, be sure to check out CoinGecko. One of the best things about this tool (besides being simple and streamlined) is the fact that it’s completely free and you’ll get an at-a-glance overview of the best performing cryptos on the market. Think of it as a couple of steps up from CoinMarketCap.

Not only do you get to see quickly how well each coin or token is performing but CoinGecko also uses key trading features, such as market capitalization, public interest, liquidity, and how much developer activity there is on the blockchain to come up with its rankings.

You can take as much or as little as you want from this tool, as it even tracks community engagement with each currency, as well as provides historical data and information on mining difficulty, should you be interested.

This is more of a tool for investors since it allows you to decide whether a project ticks all the boxes you need to feel confident in your investments.

3. Cryptowatch

Owned by Kraken, Cryptowatch presents another free charting resource that lets you track your favorite cryptocurrencies. You can check the charts and prices from all major exchanges, including Bitfinex, Bittrex, Bithumb, and Coinbase Pro.

Cryptowatch gives you one up on the market since you can watch any given comparison, say, for example, the BTC/JPY chart, and compare it to the BTC/USD. By doing this, you can glean whether certain markets are front-running others–and step ahead of large orders to gain an economic advantage.

You can also use some of the most common trading indicators such as RSI (Relative Strength Index), exponential moving averages, MACD (Moving Average Convergence Divergence), and many more. Cryptowatch is right up there with TradingView in value, although is probably more suited to seasoned traders.

4. Bitcoinity

Bitcoinity has several key features to it that short-term traders will especially like. For example, it displays combined cryptocurrency order books, as well as shows the arbitrage between cryptocurrency exchanges through an easy-to-read arbitrage table.

By visualizing the price difference between exchanges on Bitcoinity’s table, traders can capitalize through arbitrage trading. So, for example, let’s say that the price of Bitcoin was $3,800 on one exchange and $3,850 on another. The trader could simultaneously buy from one exchange and sell on another while capitalizing on the $50 difference in price.

Of course, that’s an extreme example since most exchanges display very similar prices. However, many traders use arbitrage to build up small profits over time.

Another useful feature of Bitcoinity is its tool that shows combined liquidity across all major exchanges. This allows traders to assess support and resistance levels and, for more experienced traders, calculate the price-point where major liquidity lies.

So, let’s say that the price of Bitcoin was $6,000 and there were 50,000 bitcoins on the buy-side of the order book, but 80,000 on the sell-side. That could be a sign of sell-pressure mounting which could drive price action down.

5. TensorCharts

Once you’re feeling comfortable with TradingView or Cryptowatch, TensorCharts makes a good next stop. It’s another free tool, but not for completely novice traders. Some of the advanced charts here might make your head spin if you’re not sure what to look for.

Like Bitcoinity, you can see all the major cryptocurrencies. But TensorCharts uses order book heatmaps. These heat maps pool data from order books across several different exchanges and display red and green blocks for orders waiting to be filled on either side.

This is an excellent way for traders to foresee price-action and get a decent impression of what the market makers are doing.

The Takeaway

Check out these awesome tools to add to your trading arsenal today. But do your own research as well. The type of tools a trader uses depends on their strategy, requirements, and experience. These five are just meant to get you started!