JuiceStorm TV – Are You Getting The Best Prices On Betfair?

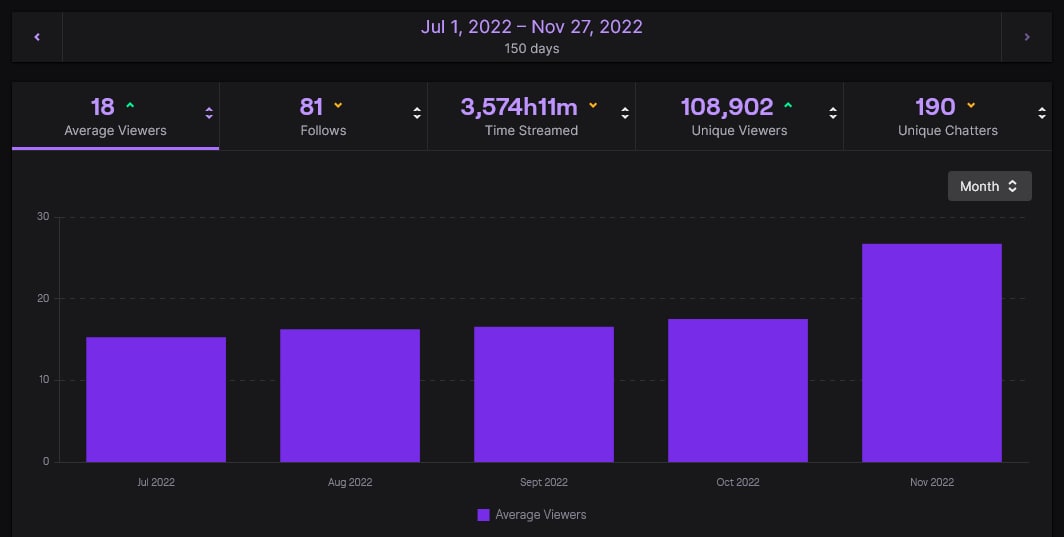

726 traders watched JuiceStorm TV live every day for the last 150 days.

- 1st GB And IE Horse Race Of The Day - April 17, 2024

- A Review For Our Next Horse Race Of Interest On Betfair - April 17, 2024

- A Review For Our Next Horse Race Of Interest On Betfair - April 17, 2024

It looks like being a strong finish for 2022 at JuiceStorm TV.

An average of 18 traders watched the stream live 24/7 for 3,574 hours.

108,902 unique viewers have tuned in since 1st July 2022 – an average of 726 traders watching JuiceStorm TV every day for the last 150 days.

You can watch our Betfair Live Stream here – it’s now our 5th year live 24/7/365.

Hundreds of traders watch JuiceStorm TV and copy what we’re doing by watching the TradeHost trading platform and we’ve always been cool with that.

But why? Firstly, it must be profitable to do so. Traders wouldn’t bother otherwise. Secondly, they don’t want to pay less than £10 per week for TradeHost or faced too many challenges trying to set up the free for life TradeHost Lite. Not everybody can get it to work even with the full instructions here .

So what’s in it for us? Well, several sharp traders in 2022 have pointed out to me that by following TradeHost on JuiceStorm TV or on Telegram – we have thousands of traders that do – it helps TradeHost members – and us – to their exits by copying the same selections to trade. All our paid members get in to their positions first because, for them, the process is completely automated.

Cool, huh? The take away for this article? It’s simple. If you want the best prices on Betfair for our selections and don’t mind an investment of less than £10 per week then joining TradeHost is your best option.